Fiscal Multipliers: Where Does the Buck Stop?

财政乘数:由谁担当重任?

At the height of the euro crisis, with government-bond yields soaring in several southern European countries and defaults looming, the European Central Bank and the healthier members of the currency club fended off disaster by offering bail-outs. But these came with conditions, most notably strict fiscal discipline, intended to put government finances back on a sustainable footing. Some economists argued that painful budget cuts were an unfortunate necessity. Others said that the cuts might well prove counterproductive, by lowering growth and therefore government revenues, leaving the affected countries even poorer and more indebted. In 2013 economists at the IMF rendered their verdict on these austerity programmes: they had done far more economic damage than had been initially predicted, including by the fund itself. What had the IMF got wrong when it made its earlier, more sanguine forecasts? It had dramatically underestimated the fiscal multiplier.

欧债危机深重之时,多个南欧国家的政府债券收益率飙升,违约风险隐现。欧洲央行及欧元区较为稳健的成员国提供纾困援助,助它们避过一劫。为了让受助国的政府财政重建可持续的根基,这些援助不无附带条件,其中最明显的当属实施严格的财政纪律。一些经济学家认为,痛苦的预算削减不得不做。其他经济学家则表示,削减预算可能适得其反,导致增长放缓,政府收入减少,受影响国家会因而更加穷困,负债更重。2013年,国际货币基金组织(以下简称IMF)对这些紧缩计划作出如下评判:它们造成的经济损害远超人们最初的预期,包括IMF自身的预估。IMF之前相对乐观的预测哪里出错了?它大大低估了财政乘数。

The multiplier is a simple, powerful and hotly debated idea. It is a critical element of Keynesian macroeconomics. Over the past 80 years the significance it has been accorded has fluctuated wildly. It was once seen as a matter of fundamental importance, then as a discredited notion. It is now back in vogue again. The idea of the multiplier emerged from the intense argument over how to respond to the Depression. In the 1920s Britain had sunk into an economic slump. The first world war had left prices higher and the pound weaker. The government was nonetheless determined to restore the pound to its pre-war value. In doing so, it kept monetary policy too tight, initiating a spell of prolonged deflation and economic weakness. The economists of the day debated what might be done to improve conditions for suffering workers. Among the suggestions was a programme of public investment which, some thought, would put unemployed Britons to work.

财政乘数是一个简单、强大而备受热议的概念,也是凯恩斯宏观经济学的一个关键要素。在过去80年里,人们对其重要性的评价变化甚大——一度视其为至关重要,之后却又将之贬得一文不值。如今,该理念再度风行。财政乘数的概念诞生于当年关于如何应对大萧条的激辩中。上世纪20年代,英国深陷经济衰退。第一次世界大战后物价上涨,英镑走弱。然而,政府仍决心让英镑价值重回战前水平。为此,政府维持过紧的货币政策,导致长期通缩及经济疲弱。当时的经济学家就如何改善困顿工人的境况展开了争论。其中一个建议是推出公共投资项目,有人认为,这可以让失业的英国人重新就业。

The British government would countenance no such thing. It espoused the conventional wisdom of the day – what is often called the “Treasury view”. It believed that public spending, financed through borrowing, would not boost overall economic activity, because the supply of savings in the economy available for borrowing is fixed. If the government commandeered capital to build new roads, for instance, it would simply be depriving private firms of the same amount of money. Higher spending and employment in one part of the economy would come at the expense of lower spending and employment in another. As the world slipped into depression, however, and Britain’s economic crisis deepened, the voices questioning this view grew louder. In 1931 Baron Kahn, a British economist, published a paper espousing an alternative theory: that public spending would yield both the primary boost from the direct spending, but also “beneficial repercussions”. If road-building, for instance, took workers off the dole and led them to increase their own spending, he argued, then there might be a sustained rise in total employment as a result.

英国政府不会接受这样的建议。它信奉当时的传统智慧——如今常被称为“财政部观点”,即通过借款融资而来的公共支出不会刺激整体经济活动,因为经济体内可供借出的存款供应量是固定的。举例来说,如果政府调用资金修建新公路,就剥夺了私营企业能得到的等量资金。经济体中某部门支出及就业的提高是以另一部门支出及就业的下降为代价的。然而,随着世界陷入萧条及英国经济危机的加深,质疑这一观点的呼声日益高涨。1931年,英国经济学家卡恩男爵(Baron Kahn)发表了一篇论文,支持另一理论:公共支出不但通过直接开支对经济起主要推动作用,还带来其他“有益的反应”。举例说,假如修路可以让工人摆脱福利救济,并使他们的个人消费有所增加,那么,他认为,整体就业可能因此而持续上升。

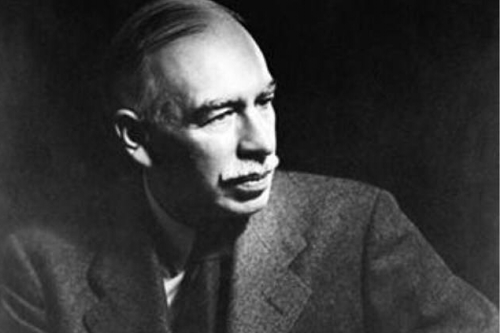

Kahn’s paper was in line with the thinking of John Maynard Keynes, the leading British economist of the day, who was working on what would become his masterpiece, “The General Theory of Employment, Interest and Money”. In it, Keynes gave a much more complete account of how the multiplier might work, and how it might enable a government to drag a slumping economy back to health. Keynes was a singular character, and one of the great thinkers of the 20th century. He looked every inch a patrician figure, with his tweed suits and walrus moustache. Yet he was also a free spirit by the standards of the day, associating with the artists and writers of the Bloomsbury Group, whose members included Virginia Woolf and E.M. Forster. Keynes advised the government during the first world war and participated in the Versailles peace conference, which ended up extracting punitive reparations from Germany. The experience was dispiriting for Keynes, who wrote a number of scathing essays in the 1920s, pointing out the risks of the agreement and of the post-war economic system more generally.

卡恩的文章和当年英国著名经济学家约翰·梅纳德·凯恩斯(John Maynard Keynes)的理念相契合。当时凯恩斯正在撰写日后成为其代表作的《就业、利息和货币通论》。在此书中,他更完整地阐述了财政乘数发挥作用的原理,以及政府可以怎样利用该乘数让颓败的经济起死回生。凯恩斯是位独特的人物,同时也是20世纪最伟大的思想家之一。他一身花呢西服,蓄着海象胡子,处处散发着贵族气息。然而,按当时标准来看,他也是位自由无拘的人,与艺术家和包括弗吉尼亚·伍尔夫(Virginia Woolf)及爱德华·摩根·福斯特(E.M. Forster)在内的布卢姆茨伯里派文人团体(Bloomsbury Group)过从甚密。凯恩斯在一战时期做过政府顾问,参与过最终向德国索取惩罚性赔款的凡尔赛和谈。这一过程让凯恩斯感到沮丧,他在上世纪20年代写过一些尖刻的文章,更广泛地指出凡尔赛和约及战后经济体系的风险。

Frustrated by his inability to change the minds of those in power, and by a deepening global recession, Keynes set out to write a magnum opus criticising the economic consensus and laying out an alternative. He positioned the “General Theory” as a revolutionary text – and so it proved. The book is filled with economic insights. Yet its most important contribution is the reasoning behind the proposition that when an economy is operating below full employment, demand rather than supply determines the level of investment and national income. Keynes supposed there was a “multiplier effect” from changes in investment spending. A bit of additional money spent by the government, for instance, would add directly to a nation’s output (and income). In the first instance, this money would go to contractors, suppliers, civil servants or welfare recipients. They would in turn spend some of the extra income. The beneficiaries of that spending would also splash out a bit, adding still more to economic activity, and so on. Should the government cut back, the ill effects would multiply in the same way.

因无法劝说当权者改变主意,加上全球经济衰退加剧,深感懊恼的凯恩斯开始撰写一部鸿篇巨著,批评当时的经济共识,并提出另外一种理念。他视这本《通论》为革命性作品,事实也被证明的确如此。该书满是深刻的经济见解。然而最重要的贡献是书中命题背后的推理。该命题是,当一个经济体在非充分就业下运作,决定投资水平及国民收入的是需求而非供给。凯恩斯认为在投资支出的变化上存在一个“乘数效应”。举例说,政府额外支出的一些资金将直接带来国家产出(及收入)的增加。起初,这部分资金会流向承包商、供应商、公务员或福利救济受益人。他们继而会把一部分的额外收入花掉。赚了这些钱的受益者也会多花一些,从而使经济活动进一步增加,如此继续。假如政府削减开支,负面影响将以相同方式扩大。

Keynes thought this insight was especially important because of what he called “liquidity preference”. He reckoned that people like to have some liquid assets on hand if possible, in case of emergency. In times of financial worry, demand for cash or similarly liquid assets rises; investors begin to worry more about the return of capital rather than the return on capital. Keynes posited that this might lead to a “general glut”: a world in which everyone tries to hold more money, depressing spending, which in turn depresses production and income, leaving people still worse off. In this world, lowering interest rates to stimulate growth does not help very much. Nor are rates very sensitive to increases in government borrowing, given the glut of saving. Government spending to boost the economy could therefore generate a big rise in employment for only a negligible increase in interest rates. Classical economists thought public-works spending would “crowd out” private investment; Keynes saw that during periods of weak demand it might “crowd in” private spending, through the multiplier effect.

凯恩斯认为,由于他称之为“流动性偏好”的因素,上述见解更显重要。他猜测,人们在可能的情况下都希望持有一些流动资产做应急之用。在金融前景不乐观之时,对现金或类似流动性资产的需求就会上升;投资者开始更担忧本钱不保,而非利钱高低。凯恩斯假定,这可能会导致“普遍过剩”:在这种环境下,每个人都把钱紧紧捂在手中,花销减少,生产及收入继而受到压抑,令人们境况更糟。如此情境下,靠降低利率来刺激经济增长并没有太大帮助。由于存款过剩,利率也不太会因政府借款增长而灵敏地发生变动。因此,政府为刺激经济而投入的支出便可能带动就业大幅上升,而造成的利率上行则微不足道。古典经济学者认为,公共工程开支对私人投资有“挤出效应”;凯恩斯则觉得,在需求疲弱时,公共工程开支反而能通过乘数效应“挤入”私人支出。

Keynes’s reasoning was affirmed by the economic impact of increased government expenditure during the second world war. Massive military spending in Britain and America contributed to soaring economic growth. This, combined with the determination to prevent a recurrence of the Depression, prompted policymakers to adopt Keynesian economics, and the multiplier, as the centrepiece of the post-war economic order. Other economists picked up where Keynes left off. Alvin Hansen and Paul Samuelson constructed equations to predict how a rise or fall in spending in one part of the economy would propagate across the whole of it. Governments took it for granted that managing economic demand was their responsibility. By the 1960s Keynes’s intellectual victory seemed complete. In a story in Time magazine, published in 1965, Milton Friedman declared (in a quote often attributed to Richard Nixon), “We are all Keynesians now.”

二战期间,政府支出增加造成的经济效应印证了凯恩斯的推理。英美庞大的军费开支促使两国经济快速增长。这样的实证,加上政府决心防范大萧条再现,促使决策者采用凯恩斯主义经济理论及“财政乘数”作为战后经济秩序的核心理念。其他经济学家继续拓展了凯恩斯的理论。阿尔文·汉森(Alvin Hansen)和保罗·萨缪尔森(Paul Samuelson)构建公式预测经济体内某一部门支出的增减将如何传导至整个经济体。各国政府想当然地把管理经济需求视为己任。到了60年代,凯恩斯理论似乎已大获全胜。1965年,在《时代》杂志发表的一篇文章中,米尔顿·弗里德曼(Milton Friedman)引述他人的话(一般认为原话出自理查德·尼克松),宣称“我们现在都是凯恩斯主义者了”。

But the Keynesian consensus fractured in the 1970s. Its dominance was eroded by the ideas of Friedman himself, who linked variations in the business cycle to growth (or decline) in the money supply. Fancy Keynesian multipliers were not needed to keep an economy on track, he reckoned. Instead, governments simply needed to pursue a policy of stable money growth. An even greater challenge came from the emergence of the “rational expectations” school of economics, led by Robert Lucas. Rational-expectations economists supposed that fiscal policy would be undermined by forward-looking taxpayers. They should understand that government borrowing would eventually need to be repaid, and that stimulus today would necessitate higher taxes tomorrow. They should therefore save income earned as a result of stimulus in order to have it on hand for when the bill came due. The multiplier on government spending might in fact be close to zero, as each extra dollar is almost entirely offset by increased private saving.

但在70年代,凯恩斯主义的共识开始破裂。其霸主地位受到弗里德曼本人观点的侵蚀,后者把商业周期的各个阶段与货币供应的增减联系起来。他认为,要使经济保持正轨,不需要花哨的凯恩斯乘数。相反,政府推行稳健的货币增长政策便可。更大的挑战来自罗伯特·卢卡斯(Robert Lucas)为首的“理性预期”经济学派。理性预期经济学者们认为,爱未雨绸缪的纳税人会令财政政策失效。他们会知道,政府借款最终是需要偿还的,而今天的刺激政策必然导致明日更高的税率。因此,他们应该把因刺激政策而赚取的收入存起来,以备来日付账之需。政府支出的乘数实际可能接近于零,因为额外支出的每一分钱几乎完全都被私人储蓄的增加抵消。

英文、中文版本下载:http://www.yingyushijie.com/shop/source/detail/id/449.html